per capita tax burden by state

The jurisdictions with the lowest overall tax rate by state for the top earners are Nevada 19 Florida 23 and Alaska 25. Walt Disney Worlds Magic Kingdom November 11 2001 in Orlando Florida.

State By State Guide To Taxes Gas Tax Healthcare Costs Better Healthcare

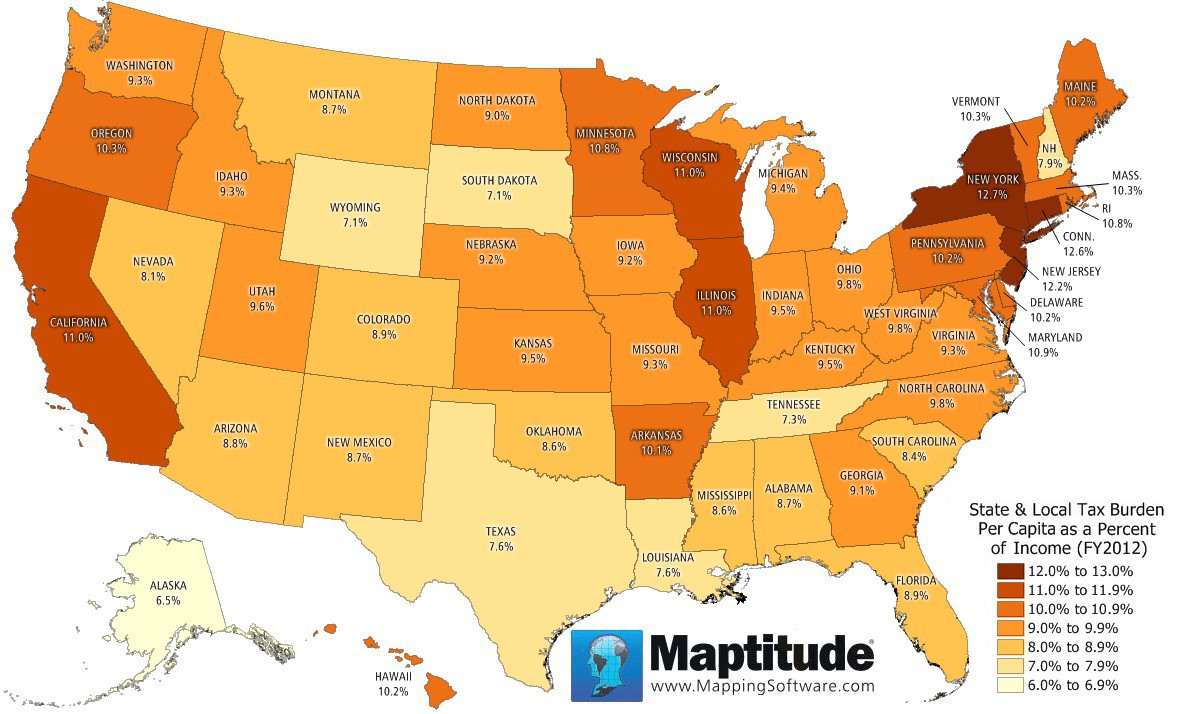

Finally New York Illinois and Connecticut are the states with the highest tax burden for the middle 60 by family income.

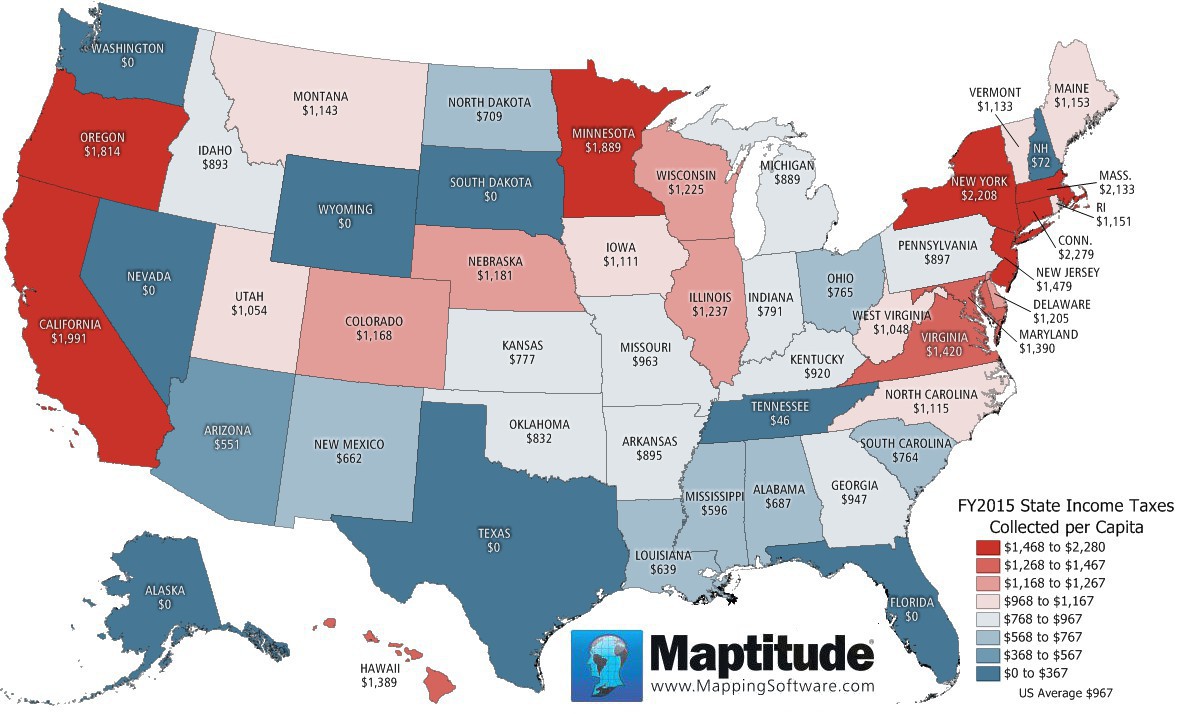

. 3 Calculated based on State Local Sales Tax Rates as of January 1 2020 from the Tax Foundation and Per Capita Personal Consumption Expenditures by State and Regions for 2019 according to the Bureau of Economic Analysis. The amount of federal taxes paid minus federal spending received per person by state can be found here. The most recent data available is from 2015.

State and local tax burdens of about 115 per 1000 of personal income were typical for Washington and the state usually. State and Local Issues. Total taxes per capita.

211 rows State tax levels indicate both the tax burden and the services a state can afford to provide residents. Our ranking of Best And Worst States for Taxes captures the total tax burden per capita not only for income property and sales tax but. States use a different combination of sales income excise taxes and user feesSome are levied directly from residents and others are levied indirectly.

State-Local Tax Burden per Capita Taxes Paid to Own State per Capita Taxes Paid to Other States Per Capita. Our ranking of Best And Worst States for Taxes captures the total tax burden per capita not only for income property and sales tax but. We share the overall tax burden by state for an average household to help decide where to move.

The state with the highest tax burden based on these three types of taxes is New York which has a total tax burden of 1228. This table includes the per capita tax collected at the state level. Chart 2 portrays the change in per capita state and local taxes since 1970 for Washington and the average for all states.

The effective tax burdens in these states are 125 122 and 116. State and Local General Expenditures Per Capita. Explore the latest state-local tax burden state and local tax burden rankings as of 2019.

North Dakota ranks first with 7438 per capita and Alaska is second. Our ranking of Best And Worst States for Taxes captures the total tax burden per capitanot only for income property and sales tax but. A per capita tax comparison is far from complete however because differences in the level of.

State and Local Issues. Sales and gross receipt taxes. State and Local Tax Revenue Per Capita.

State Tax Maps How Does Your State Rank Tax Foundation

States With The Highest And Lowest Property Taxes Property Tax Tax States

Individual Income Tax Collections Per Capita Tax Foundation

2016 Property Taxes Per Capita State And Local Property Tax Home Buying Buying A New Home

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Maptitude Map State Income Tax Burden

Map Of Income Taxes And Social Securities By Country In Europe Map Europe Map Country Maps

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Happy Retirement Quotes

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

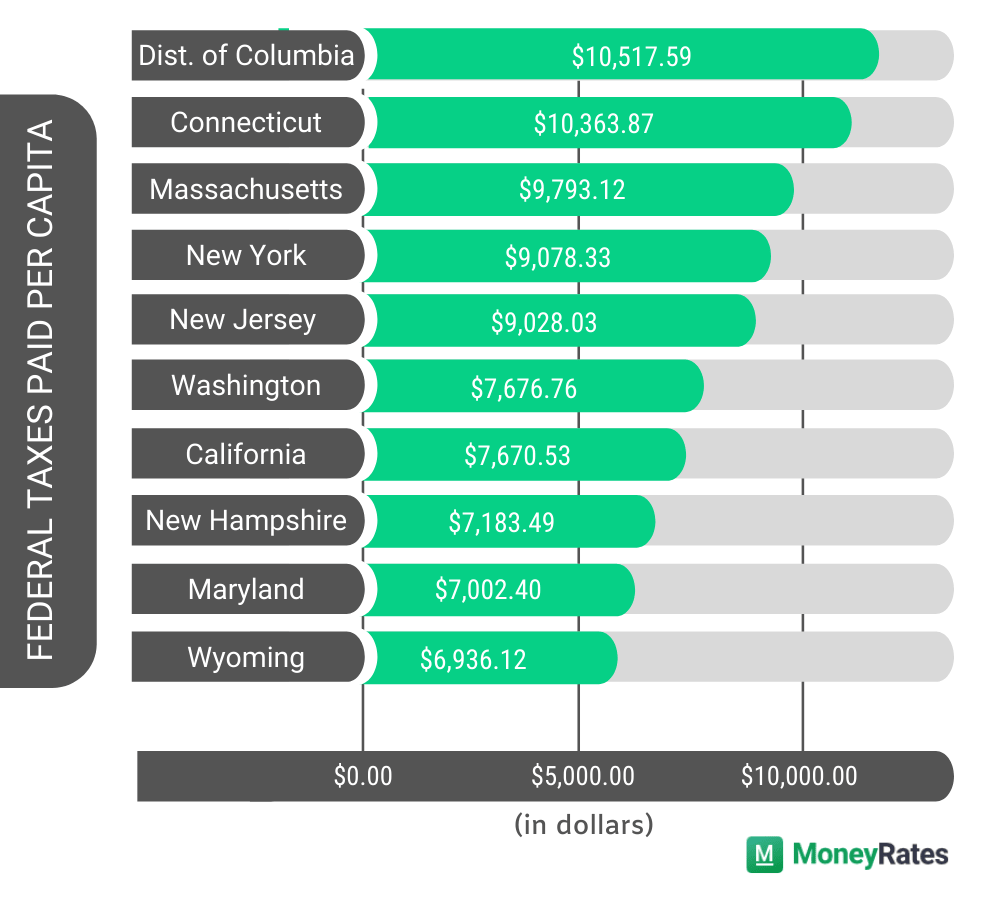

Which States Pay The Most Federal Taxes Moneyrates

Maptitude Map Per Capita State Income Taxes

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Sales Tax Collections Per Capita Places In America Rapid City Map

Tax Burden By State 2022 State And Local Taxes Tax Foundation

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax State Tax

Per Capita U S State And Local Tax Revenue 1977 2019 Statista

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement