santa ana tax rate

California CA Sales Tax Rates by City S The state sales tax rate in California is 7250. Look up the current sales and use tax rate by address.

Measure X The City Of Santa Ana

This is the total of state county and city sales tax rates.

. The County sales tax rate is. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. The New Mexico sales tax rate is currently.

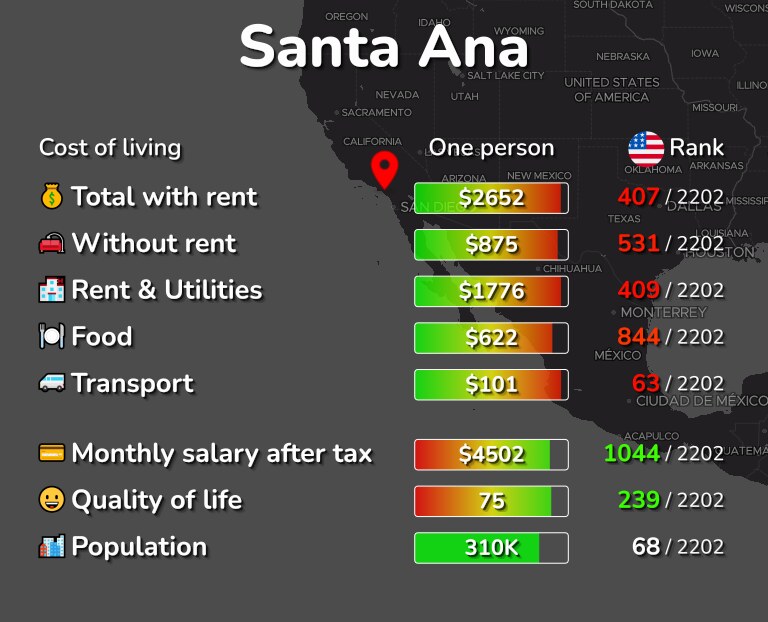

Income and Salaries for Santa Ana - The average income of a Santa Ana resident is 16345 a year. School District Bond Rate. City of Seal Beach located in Orange County 694.

The following chart shows average annual property tax rates for each Orange County city for a 3-bedroom single family home. 15 for Santa Ana Tax. Santa Ana voters approved ballot measure AA on November 4 2014 which reduces the Utility Users Tax rate from six percent 6 to five and one half percent 5 ½.

How does this new tax compare to the rates of other cities. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The Santa Ana Pue sales tax rate is.

Santa Ana has the highest tax rate in Orange County at 925 with Fountain Valley Garden Grove Placentia Seal Beach Stanton and Westminster 5 behind at 875. See below for tax rates elsewhere. Prior to the passage of Measure X Santa Anas 775 sales tax rate was one of the lowest in the County and was lower than the rates of similarly sized cities of Long Beach 1025 Oakland 925 Riverside 875 and San Bernardino 80.

California has recent rate changes Thu Jul 01 2021. Santa Ana 111765. You can print a 925 sales tax table here.

The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax payment is 2943. Select the California city from the list of cities starting with S below to see its current sales tax rate. The minimum combined 2022 sales tax rate for Santa Ana California is.

With local taxes the total sales tax rate is between 7250 and 10750. - Tax Rates can have a big impact when Comparing Cost of Living. The new tax rates tax codes acronyms and.

School Bond information is located on your property tax bill. You may pay your tax bill in person from 800-500 Monday thru Friday. Starting Monday Garden Grove Placentia and Seal Beach will see a 1-percent sales tax increase for a total of 875 percent while Santa Ana will see a 1 12-percent increase bringing its sales.

The minimum combined 2022 sales tax rate for Santa Ana Pue New Mexico is. The Treasurer-Tax Collectors Office is located in the Hall of Finance and Records at 12 Civic Center Plaza in Santa Ana CA on the ground floor Room G-58. New Sales and Use Tax Rates Operative April 1 2019 The tax rate changes listed below apply only within the indicated city or county limits.

Did South Dakota v. Use the Property Tax Allocation Guide. In the city limits of Las Cruces at 2021 residential tax rate of 0031258.

Which Orange County CA cities have the lowest and highest property tax rates. The budgettax rate-determining process usually gives rise to customary public hearings to discuss tax rates and related budgetary questions. Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The US average is 46. Some information relating to property taxes is provided below.

1788 rows California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. La Habra and La Palma also have higher tax rates at 825. Wayfair Inc affect California.

Orange County Sales Tax by City. The December 2020 total local sales tax rate was also 63750. For tax rates in other cities see California sales taxes by city and county.

Did South Dakota v. City of Santa Ana located in Orange County 692. Net Taxable Value Mil Rate.

Keep in mind that under state law taxpayers can elicit a vote on proposed rate increases that exceed established limits. 925 Highest in Orange County 725 for State Sales and Use Tax. - The Income Tax Rate for Santa Ana is 93.

Santa Ana must adhere to provisions of the California Constitution in levying tax. The current total local sales tax rate in Santa Ana Pueblo NM is 63750. In accordance with state law utility service providers are in the process of implementing the new voter approved rate structure which shall be effective for all service.

This is the total of state county and city sales tax rates. The County sales tax rate is. Seal Beach 107974.

The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025 Orange County sales tax 15 Santa Ana tax and 15 Special tax. The Santa Ana sales tax rate is. The California sales tax rate is currently.

05 for Countywide Measure M Transportation Tax. - The Median household income of a Santa Ana resident is 52519 a year. There is a payment drop box at the main entrance of the building for your convenience.

The US average is 28555 a year.

Orange County Property Tax Oc Tax Collector Tax Specialists

The Poorest 20 Percent Of The Population End Up Paying Double State Tax Rate As The Top 1 Percent Institute Of Tax And Economi State Tax Income Family Income

Sales Tax In Orange County Enjoy Oc

Economy In Santa Ana California

Food And Sales Tax 2020 In California Heather

Orange County Ca Property Tax Calculator Smartasset

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Who Pays The Transfer Tax In Orange County California

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

California Sales Tax Rates By City County 2022

A Lavar Taylor Law Offices Of A Lavar Taylor Santa Ana California Ppt Video Online Download

Measure X The City Of Santa Ana

Sales Tax Rates In Major Cities Tax Data Tax Foundation

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Cost Of Living In Santa Ana Ca Rent Food Transport

Food And Sales Tax 2020 In California Heather

Orange County Ca Property Tax Calculator Smartasset

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders